Avoid Box 3 tax and move to a BV?

Avoid Box 3 tax and move to a BV? That will probably one of the frequently asked questions now the

1016 CS Amsterdam

Lines close at 4pm

Our office hours

Avoid Box 3 tax and move to a BV? That will probably one of the frequently asked questions now the

Receiving pension benefits in another country then the country in which you contributed is not a problem. Until it is

Challenging Box 3 assumed yield procedure update. We experience excitement among tax payers to fight the horrible Box 3 assumed

Renting out the house is the most frequently asked question during one of the expat housing seminars we are part

More often we experience the mortgage advisor giving tax advice. It goes without saying that giving advice outside your expertise

The ultimate guide to filing Dutch income tax: key deadlines and tips is an insight from the perspective of the

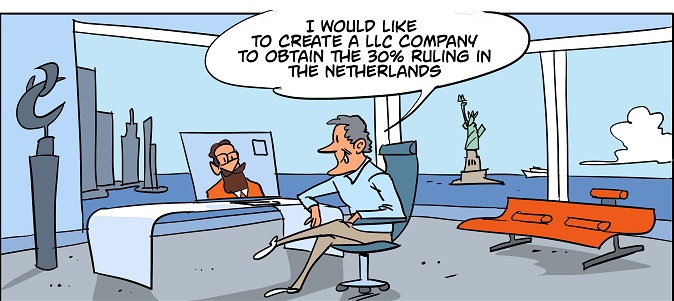

The BV company is the Dutch limited liability company. 10 common mistakes when setting up a BV is what this

The 2024 income tax return can be filed starting from February 1 next. We will be pleased to assist you.

Box 3 tax payers received a message from the Dutch tax office this week. They think, we finally can start

One client is no client in 2025 is the standpoint of the Dutch tax office. Rules will be enforced from

Avoid Box 3 tax and move to a BV? That will probably one of the frequently asked questions now the assumed yield for coming year

Receiving pension benefits in another country then the country in which you contributed is not a problem. Until it is a problem. Receiving pension benefits

Challenging Box 3 assumed yield procedure update. We experience excitement among tax payers to fight the horrible Box 3 assumed yield. Update about the procedure.

Renting out the house is the most frequently asked question during one of the expat housing seminars we are part of. Is it possible, is

More often we experience the mortgage advisor giving tax advice. It goes without saying that giving advice outside your expertise does not equal something positive.

The ultimate guide to filing Dutch income tax: key deadlines and tips is an insight from the perspective of the tax advisor. We have over

The BV company is the Dutch limited liability company. 10 common mistakes when setting up a BV is what this article is about. Mistake 1:

The 2024 income tax return can be filed starting from February 1 next. We will be pleased to assist you. The question is, do you

Box 3 tax payers received a message from the Dutch tax office this week. They think, we finally can start claiming back the tax. But

One client is no client in 2025 is the standpoint of the Dutch tax office. Rules will be enforced from coming January. What does this

For deeper coverage of various Dutch tax topics, download one of our White Papers from the menu.