Starting your BV company could be a desire you have, and maybe now it is time to actually start. We will be pleased to assist you.

Starting your BV company – why the BV company?

The BV company is the limited liability company type. That is the more complex and more costly equivalent of the one man company. So why chose for the BV company?

The BV company stands for limited liability company. In theory that would imply your liability is limited, but in practice that is nearly never the case. The BV company you use for different reasons mainly: possibility to involve partners, investors, sell the company when successful.

The share capital of the BV company offers you the opportunity to set up the BV with partners. Pro rata for the share in the company, the shareholders are awarded.

The BV company also offers the possibility of different types of shares, for instance A and B shares. A are the regular shares and B for instance the shares that are entitled to profit, dividend, and liquidation payment, but have no voting rights. Those shares you often use for investors. You would like to make them part of the company, but you prefer the investor does not have an opinion via voting how to run the company.

Limited Liability not being limited

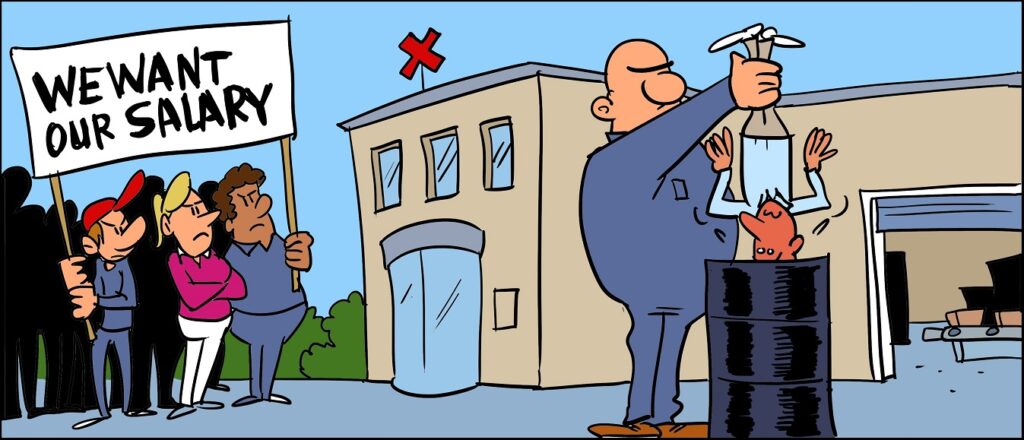

Above I touched the subject that the liability in the Limited Liability company is not really limited. This is caused by multiple reasons.

Firstly the share capital of the BV. The moment a BV is incorporated the notary asks about the amount of the share capital. That can be any amount and some chose for EUR 0,01. The limited liability company starts the day the share capital is paid. Often that is forgotten.

Then if the BV takes out a loan, the bank also has the shareholder sign for liability. The same applies in case of a legal issue. Not only the BV is held liable, also the person performing the service in name of the BV, often the shareholder, is held liable personally.

In case of bankruptcy of the BV and the shareholder took more from the BV than the combined salary and or dividend, the curator will ask the shareholder to pay back the amount. If that is not possible, due the shareholder having no money, the curator will make the shareholder go bankrupt personally.

Finally, if a dividend payment causes the BV to have a liquidity issue later, the dividend payment procedure is challenged, which could lead to personal liability of the management, often the shareholder, as well.

Hence the limited liability is not that limited.

BV company and selling the shares

The moment you started a BV and it turns out to be successful. So successful you can sell the shares you hold in the BV company. Then the profit you make with the sale of the shares is taxed in Box 2.

Box 1, 2 and 3 are the boxes we have in the income tax return. Box 1 is your employment income, ZZP income and mortgage deduction. The Box 2 is for shares you hold in a company exceeding 5%. Box 3 are your worldwide assets being taxed.

The moment you sell the shares in your BV you pay Box 2 tax. That is also the case if you receive a dividend. The Box 2 taxation can be prevented by holding the shares of the working BV in a so called holding BV.

The participation exemption makes that a result made by a Holding BV such as a dividend or a capital gain on the shares of a participation exceeding 5% is, tax free. The moment the holding company pays out this result to its shareholder, being a private person, then Box 2 tax applies again. This is made possible for entrepreneurs to reinvest the proceeds pretax in the next adventure.

Mind you, maintaining a holding structure is from an accounting costs point of view expensive. In other words, consult us first before you act, as if you never sell the shares, or make a profit, there is no point in such a structure.

BV company an moving abroad

The day you expect to make profit on the sale of the shares, is maybe the day you plan to move abroad to avoid the Box 2 taxation. That is human behavior. The Dutch tax office is experienced with working with humans, hence an exit tax is in place.

The day you move abroad becomes a fiction moment. The fiction is, that it is done as if the shares are sold at that day. This implies the value of the shares need to be determined. A sale that has been agreed upon, but not yet affected, is taken into account in this value determination.

The moment you left the Netherlands, keeping the BV company shares, has consequences for the substance in the Netherlands, if you are also the director. The filing obligation in the Netherlands for corporate income tax purposes remains as long as the BV exists. Even if there is no more substance in the Netherlands.

Tax is exciting

We think tax is exciting. Setting up a BV, creating a company and be successful is a dream. The related legal and tax aspects of the BV could be less glamorous and therefore we are excited to assist you.