How Does Payroll Work for Foreign Employers in the Netherlands?

Payroll Work for Foreign Employers in the Netherlands is a hot topic, as many employees move to the Netherlands for

1016 CS Amsterdam

Lines close at 4pm

Our office hours

Here are the blog posts tagged with the term you were searching for.

Payroll Work for Foreign Employers in the Netherlands is a hot topic, as many employees move to the Netherlands for

The BV company is the Dutch limited liability company. 10 common mistakes when setting up a BV is what this

The one client is no client solution. The creative persons referring to themselves as tax advisors have plenty of solutions.

Doing business in the Netherlands can involve employment. Employment and Dutch taxation are sometimes a topic of hesitance due to

Stock options exercised and tax, FAQ. One the question is asked by the employee what options they have. Indeed, what

Being a sole director of a foreign company residing in the Netherlands, makes the foreign company subject to Dutch rules

Employer abroad – working remote – Dutch taxation that is a frequently asked question, the answer is simple, the execution

Minimum salary shareholder director is a topic that needs to be addressed the moment a shareholder director operates in the

We have an employee in the Netherlands! This could cause distress with foreign employers. The only stories told to them,

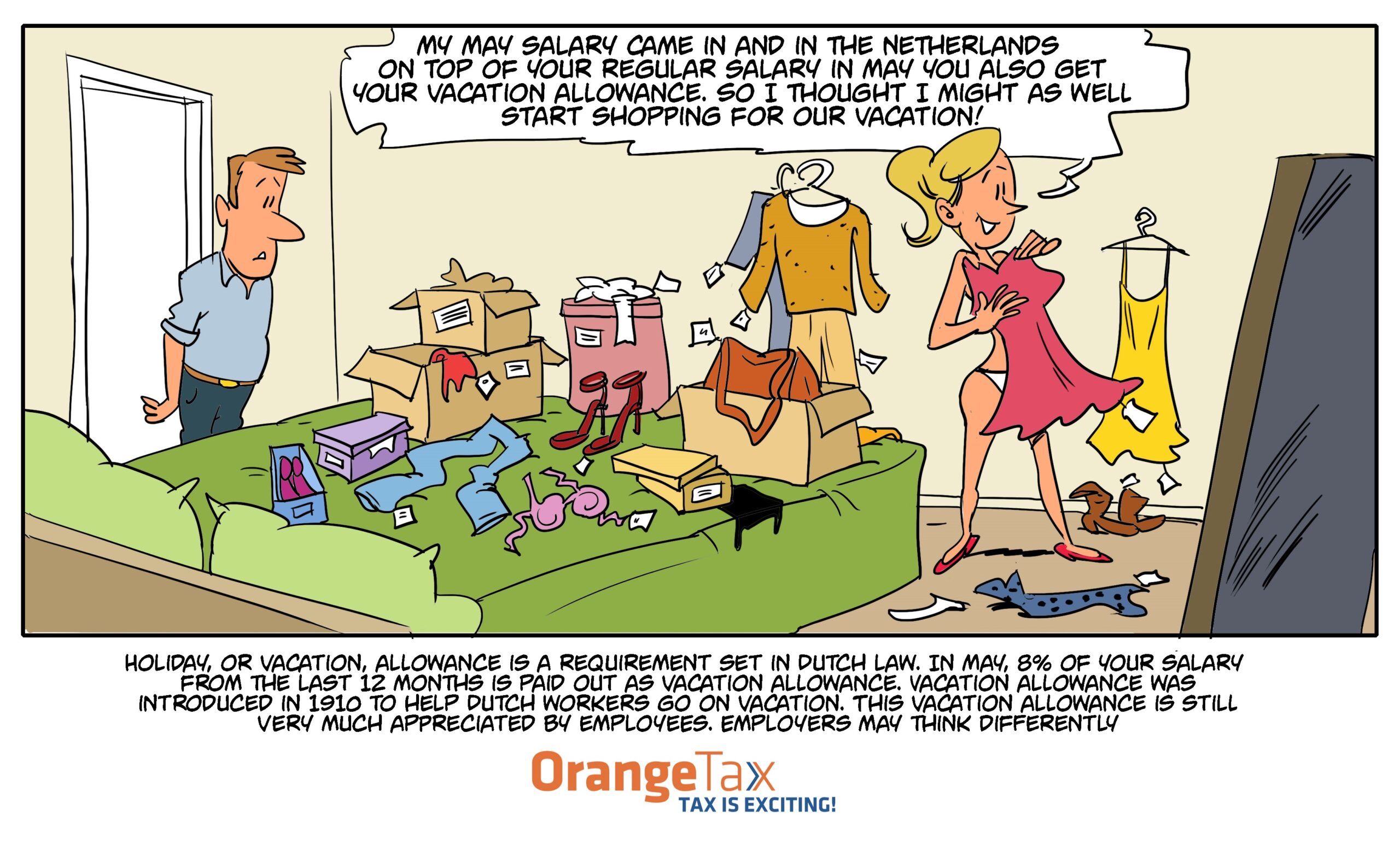

A payroll correctly done is a joy for everybody. An obvious statement, but there is more than the eye can

For deeper coverage of various Dutch tax topics, download one of our White Papers from the menu.