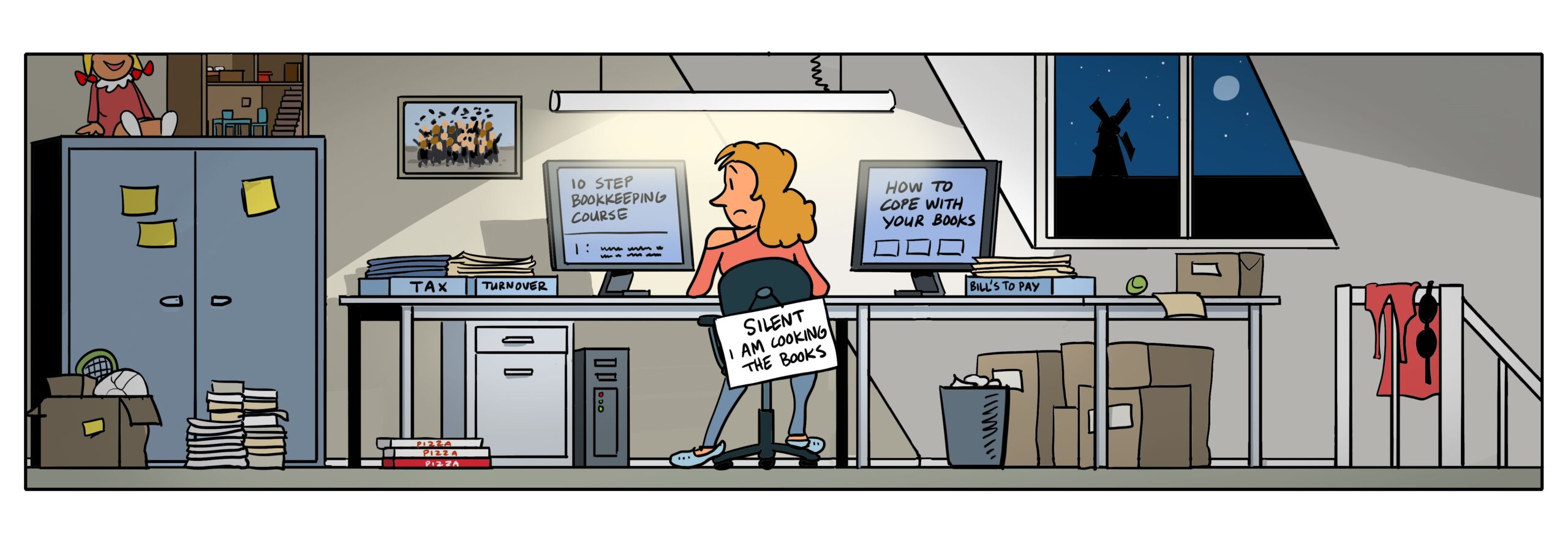

Doing bookkeeping yourself with AI?

Doing your bookkeeping yourself with AI is the period of time we life in right now. Should you process your bookkeeping with AI?

Doing bookkeeping yourself with AI

This article is written by a bookkeeper, tax advisor and seasoned entrepreneur, to put it into POV. Yesterday I wanted to create a website for our new webinar platform: SetupDutchBV.nl. There was not a single person that did not inform me that with AI I can build a website in 1 minute.

So I purchased a subscription with a well-known website software company. And indeed in 1 minutes I had with the help of AI the website I envisioned. I was totally surprised it is indeed possible. You state in AI in that software what it is you do, who you want to reach and layout idea, and voila, there is the website. Speakers, contact persons, about us. Everything.

Then I started to customize the website with the content I think should be on the website for the audience to understand what is offered and who will speak. I changed one page, the awesome layout instantly turned to flat blue ugly layout. That should be fixed later was my thought. Then I saved and looked at the updated website only to learn that also the about us page and the other pages had changed identical. Ugly blue flat text, same text.

It took me about three hours, but by then I had even mutilated the header page that looked so awesome. Suddenly a red notice came up suggesting I might want to start fully over again. Yes indeed, but I could not exactly remember the AI suggestion I made first time. The new outcome was way too straight business like, even I would not like to attend a webinar with that feel and touch.

Having spent more hours, I contacted our Rick the web developer, and spilled my beans. Rick is a very nice guy and understanding.

Doing your bookkeeping yourself with AI

I assume you took notice of my introduction above to expect where I will be going. Yes, indeed you can purchase a not too expensive bookkeeping software program. And indeed globally bookkeeping is identical, the balance needs to balance and the profit and loss shows the result.

How wonderful is it to upload your first invoice with this software, but where did it go? Have you been able to indicate in the software how to classify this invoice? Is the VAT processed correctly? Was there VAT, and if there was no Dutch VAT on the invoice, was there still VAT reclaimed? Can you adjust that. Was this an investment (balance) or a cost (profit and loss).

And the bank connection you successfully made with your software program, how do you process private costs paid from the business bank account? It is so easy to not look at that and process as company costs, who will know? With the investments booked as costs, the deposit booked as costs. And your money take out of the business bank account booked as costs, your result looks good from a tax point of view.

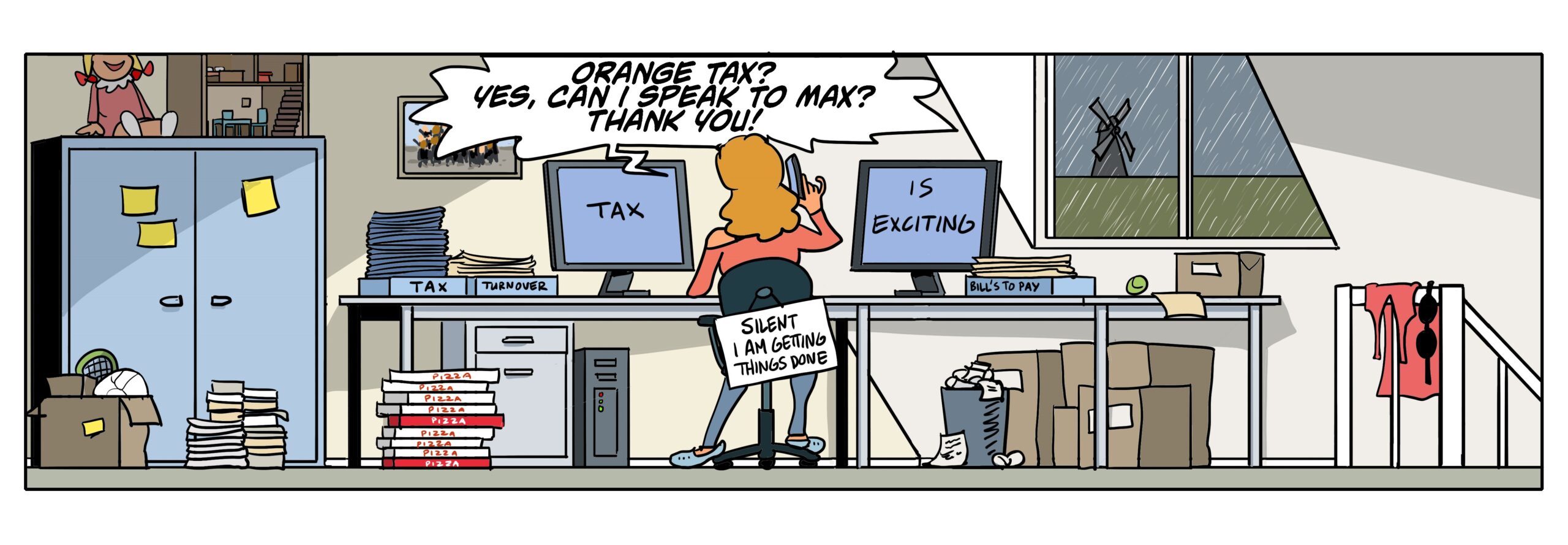

You doing the bookkeeping with AI experience feels good

If my AI website development would have given me the result I had envisioned, I would be proud as a peacock. And I think when you processed your bookkeeping as addressed above, you would feel the same. Who needs a bookkeeper?

Who needs a bookkeeper?

During your path of processing the bookkeeping yourself, with no bookkeeping experience other than what AI informs you about, issues are to happen.

Let us assume you would like to rent a house or purchase a house. Then the landlord or mortgage company would like to see the results of the past three years. If you already engaged yourself in some sort to the house, it can become very unpleasant if your balance and profit and loss are rejected. And if you inquire why they are rejected and you learn that it looks very fraudulent, that is the moment you feel you need a bookkeeper.

A little bit of both – doing it yourself and asking the bookkeeper to finish the annual report

We experience exactly what is stated above on a weekly basis. The entrepreneur finds the costs of the accountant overrated. Everybody tells the entrepreneur you can do your accounting yourself with AI. Then the time to file the income tax return comes, and the entrepreneur feels uncomfortable after all. He or she processed the books all by themselves, but very uncertain if it was done any good. So up to the bookkeeper to see if they passed the examn.

What do we experience by entrepreneurs doing the bookkeeping themselves?

The client was visited with the family car. Petrol costs and parking costs were paid and deducted by the company, without adding 22% of the Dutch catalogue value of the family car to the result.

The client outside NL inside the EU was invoiced at 0% without taking into account any of the invoice obligations, nor reporting this ICP sale in the VAT return.

The laptop of EUR 850 ex VAT was fully deducted in the profit and loss, instead of depreciating over a 5 year period. Plus the laptop was purchase outside NL inside the EU with VAT and that foreign amount of VAT was claimed back in the Dutch VAT return.

The entrepreneur travelled, consumed food and drinks of which all were paid by and deducted from the company. None of the receipts show with which client this food was consumed.

Part of the rent of the house was deducted in the profit and loss, for the home office space. We also see this happening with part of the mortgage. The negative consequence this has are immense. The moment the company is stopped, or you move house, the part of the house deducted in the profit and loss need to be sold back to the entrepreneur at market value.

I did the bookkeeping myself and still the bookkeeper charges a high fee

The above mentioned situations are some we frequently see, but there are many more. As we have an obligation to the Dutch tax office to be as professional as we claim to be, we need to correct all the incorrect bookings. That is a time consuming exercise. We first need to start with the balance in our system, then make the changes. Moreover, the outcome of the result, much higher, is argued by the entrepreneur.

The moment we present the invoice, the entrepreneur finds it difficult to understand. So much effort he or she put in processing the bookkeeping. Long days made to get it all in the system, and then still paying so much to the bookkeeper.

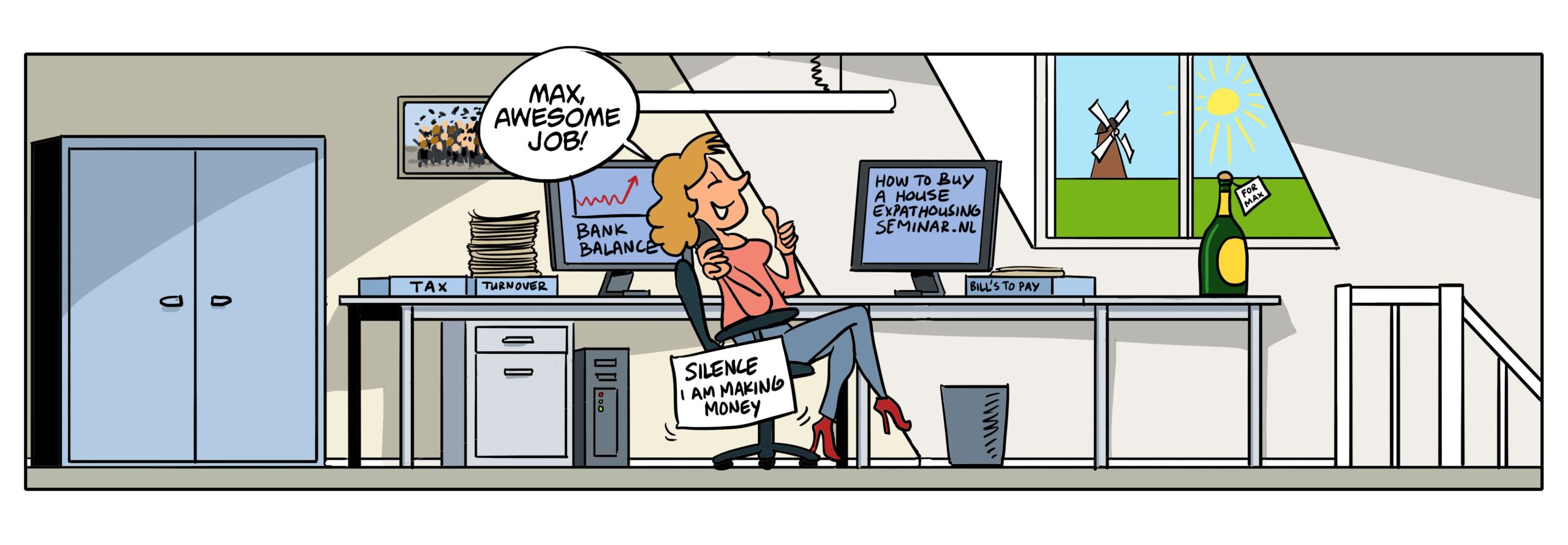

Tax is Exciting

We think tax is exciting and we are excited to process your bookkeeping. Indeed, you do your business and make money. We make sure the business is correctly reported to the Dutch tax office. Even more, feel free to visit us to discuss what could be done better, differently or more tax efficient. Then you excite out bookkeeping department much more than first trying to do it yourself with no bookkeeping experience bothering you.