How fast can you incorporate a Dutch BV company? As with many things, if you prepared yourself well, the incorporation can be quick.

How fast can you incorporate a Dutch BV company?

This is one of the frequently asked questions. Regardless, in reply we first ask for what the Dutch BV company is required? For instance, if that is for the sole reason to employ a staff in the Netherlands. There are more efficient solutions that setting up an entity in the Netherlands.

Often the reply is to do business in the Netherlands. Hence the next question we ask is:

Will the director of the Dutch BV become a Dutch tax resident?

The moment you incorporate a Dutch BV company with the aim to do business, you have expectations. Expectations such as that you can open a business bank account, that your BV is subject to Value Added Tax.

However, if the director is not going to be a Dutch tax resident, the BV company has no substance in the Netherlands. That implies the BV still needs to file a corporate income tax return. But the bank will not open a business bank account. The Dutch tax office can have the opinion that there is no ground to allocate a VAT entrepreneurship to the BV company.

The moment a Director being a Dutch tax resident is being appointed, then:

Preparations for a swift BV company incorporation

The notary is the only person in the Netherlands that can incorporate a BV company for you. And the notary has a list of questions for you. If you prepared the answers, the notary can be quick.

The obvious question is the name of the BV company. And it is handy to already check at www.kvk.nl which names have already been used, to avoid possible legal issues.

The address of the BV company. Now here is a chicken and egg issue. If the company would like to rent an office, then an office cannot be rented without a VAT number. The VAT number is only issued after incorporation. You need to ask the concerning organization to have a little patience and that the VAT number is soon issued.

The share capital, can be as low as EUR 0,01 but is that wise. You need to be able to inform the notary what share capital you desire.

Who will be director, how many shareholders. Are all the shareholders equal or do you need shares A and B with different rights. Is the director limited in his rights. Would you like to have a long first financial year or not.

Best is to connect with the notary of your choice for incorporation, ask for the list of details and prepare that.

Incorporation in one day

If you prepared the list, identified yourself with the notary, then in theory the BV could be incorporated in one day.

One more aspect

One more aspect that is often disregarded, but rather important: payment of the share capital. Only after the share capital has actually been paid by the shareholder the limited liability starts. Not before. So if you incorporated with the silly EUR 0,01 and you forget to pay the one cent, no limited liability. On the balance that EUR 0,01 is often shown as a zero, hence third party person could have the impression you did not pay up the share capital.

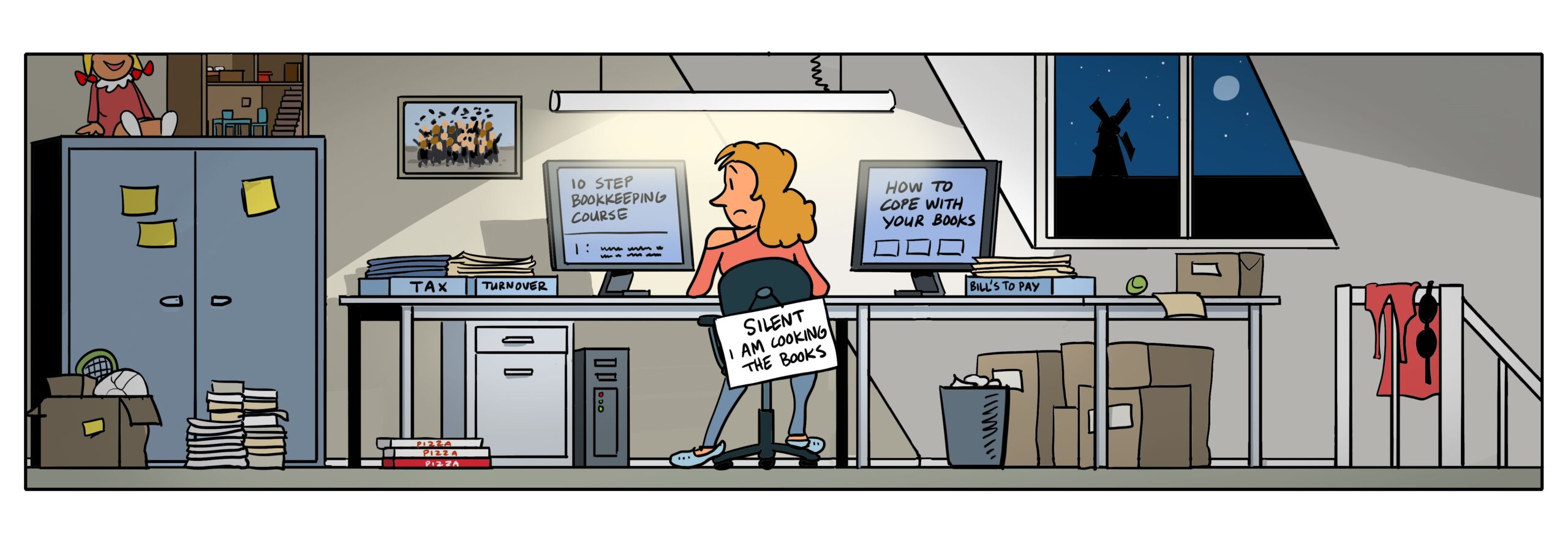

Tax is exciting

We think tax is exciting. Running the accounts for a BV company is exciting too. We will be glad to assist you with a newly to be incorporated BV or continue already existing BV company. Our fees you find on our website.