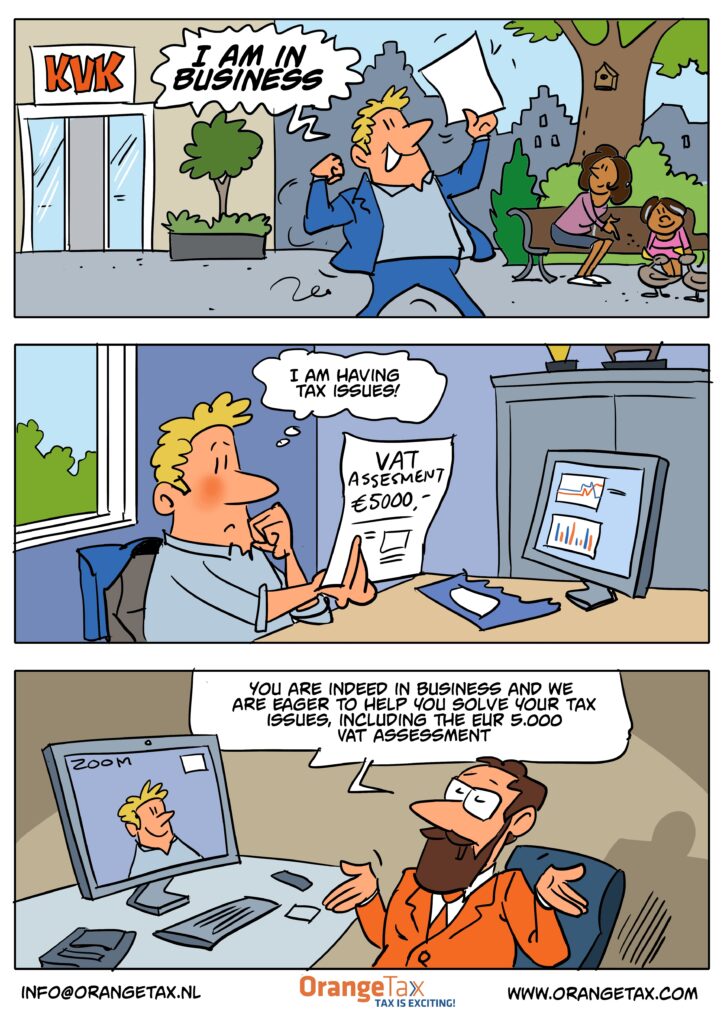

You registered yourself as ZZP freelance entrepreneur and instantly the tax office provides you with a EUR 5.000 penalty. What have you done wrong?

ZZP and EUR 5.000 penalty

The ZZP company is a transparent company which implies you as a person becomes an entrepreneur. The Chambers of Commerce will register you as such. The Dutch tax office will issue to you a Value Added Tax number.

The VAT number is the problem. With the number you receive the deadlines you need to meet. Sometimes you even receive a pinkish form for a shorter period than a quarter to complete.

If you fail to complete either the pinkish form and or the regular quarterly VAT return, you receive this EUR 5.000 penalty.

Is the penalty a problem?

Yes and no. Yes, any penalty is a problem, especially if you are the person that needs to pay. No, probably this penalty can be solved.

Why is the penalty send to you?

The tax office has many years of experience of working with human beings, and they tend to respond better to a penalty, then to a reminder letter. From an efficiency point of view the tax office sends the reminder. However, the aim of the tax office is not for you to pay the penalty. The aim of the tax office is to solve the penalty by filing the Value Added Tax return.

The moment the VAT return is send for the concerning period, often the issue is solved. However, some people are slow to comply. Then only filing the VAT return is not sufficient, then also a complaint needs to be made against the penalty. The penalty for being late, EUR 65, we cannot solve, as you were too late. The penalty for paying late might be able to be solved, depending on the fact if you need to pay VAT.

Experience learns that the first VAT return often results in a refund or zero return. After filing the first VAT return the entrepreneur is aware of its obligations and the penalty will not come again.

What if you simply pay the penalty?

If you pay the penalty, but you still do not file the VAT return, the case is not solved. Yes, the penalty problem is no longer there, but you are still obliged to file a correct Value Added Tax return.

We have experienced a client simply paying the EUR 5.000 penalty. The next quarter it was EUR 7.500, then EUR 10.000 then EUR 11.500. All paid. A lady working with the tax office phoned us with the question why all penalties were being paid. We were not aware of the penalties, so we contacted the client. The client was aware of the penalties and every time the penalty was much lower than the actual VAT amount, hence he chose to pay the penalty instead.

Paying the penalty does not imply you have no more obligation to file a correct VAT return.

Tax is exciting.

We think tax is exciting. We are excited to assist you with your EUR 5.000 penalty. Not only we think we can make you happy with not paying this fine. Also we think we can contribute to you with processing the bookkeeping, answering questions and maybe solving more tax issued you might have.